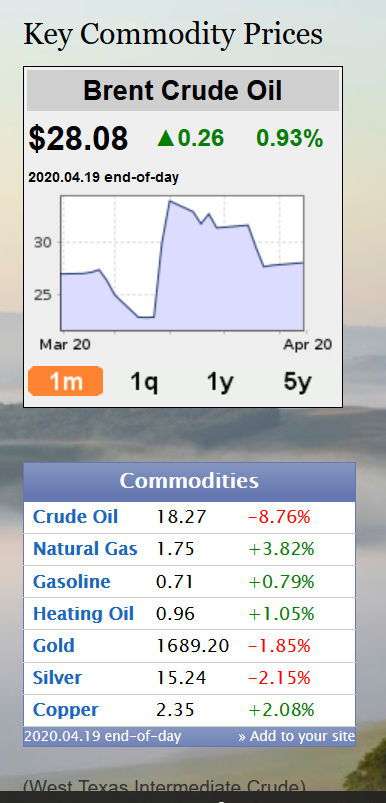

As my personal blog tracker reports:

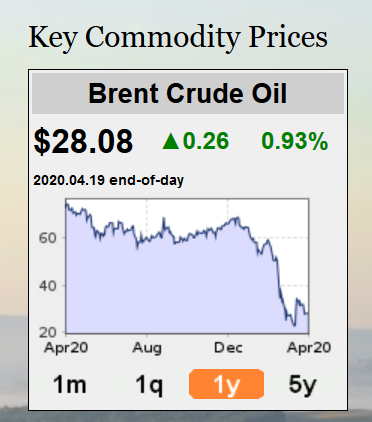

Let me add, a 1-year look:

This of course reflects the impact of economic slowdown due to lockdown, but it also implies room for considerable stimulus. END

PS: A look at going into depression:

A strongly shocked economy can tumble well within the PPF, sticking there for years, as in the 1930’s. A long enough pandemic lockdown could send it there. However, I doubt it, though a recession is likely.