I put up a post on MindMatters today about the stock market with a provocative title – “Everyone Can Beat the Market”. It’s not actually about the stock market, but that was the area I was thinking about at the time. It was, in fact, a piece on thinking about causation.

Most people (including experts) tend to have a one-level view of causation. That is, they have a static idea of what the subject matter is, and then they look to see how the pieces bounce around within that static structure. That more or less works for physics. It totally fails everywhere else.

The fact is, in every social interaction, effects become causes of future happenings. Not only that, the effects modify not only the things modeled, but also the static structure that the model assumes. Imagine, for instance, if a gravity experiment actually changed gravity permanently.

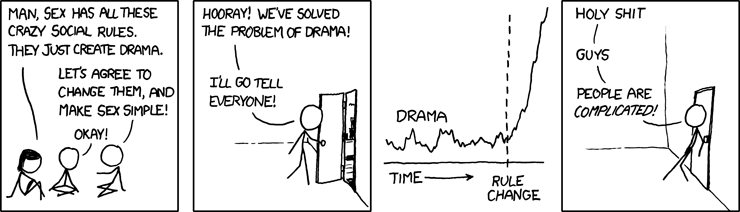

A great illustration of this is a cartoon from XKCD.

The problem being described here isn’t just that people are complicated, it’s that the effects change the structure of the game itself. That’s why modeling it is so hard.

This has dramatic effects in everyday life that we don’t even recognize, because our faulty analogy of human causation with physical causation has programmed us not to recognize them.

In the article, I point out that the effects of investing decisions actually effect the market itself. We tend to think of the market as a static structure, but it’s not. The members of the market, the legal rules they utilize, the social rules they utilize, the relationships between the players – all of these things are subject to change.

Take WeWork for instance. It never actually made it to be a part of the market, but it’s failure to materialize will change the decision-making of the market and the precursors to the market for a long time. This means that it will be a *different* market than before. The typical decision-making will be different than before. The risk/reward analysis will be different than before, etc.

While this isn’t meant to focus on politics, I wanted to point out another way that this manifests. In the 2016 election, everybody said, “you have to choose one, so choose the lesser of two evils” (or at least that’s what my friends said). I decided to vote for no one, because no one met my minimum standard. Now, by myself, that does nothing. However, imagine that a large group of people had voted for no one. Do you think that this would be a phenomena that the pollsters would miss? While it is true that I would have failed to effect change of the outcome of 2016, if a large group did it, it could mean the change of the outcome of every election afterwards, as the powers-that-be who run candidates realize that they actually have to appeal to us, and not just run a “not-as-bad-as-that-guy” campaign. The popular mindset says that *this* present outcome is the only thing that matters. But that’s because they all view the game as static.

When you realize that the game itself changes based on your participation, you look at every decision you make differently.

This is why I don’t care about 99% of what psychology or sociology says. Nearly the whole field is chasing mathematical models, not recognizing that the choices you make changes the model itself.